federal estate tax exemption 2020 sunset

With adjustments for inflation that exemption in 2020 is 1158 million the highest its ever been reports the article Federal Estate Tax Exemption Is Set to ExpireAre You Prepared from. The estate tax exemption amount for 2020 is 1158 million and is subject to inflation adjustments each year until the law sunsets on December 31 2025.

Gift Money Now Before Estate Tax Laws Sunset In 2025 Press Enterprise

Should the same married couple pass away after the current federal estate tax provisions expire on December 31 2025.

. After 2025 the exemption amount will sunset a fancy way of. The 2022 exemption is 1206 million up from 117 million in 2021. In 2018 the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax exemption to.

On November 2 2017 in an unprecedented gesture of fiscal generosity Congress passed the Tax Cuts and Jobs Act and increased the federal unified gift and estate. In 2018 the Tax. For 2022 the federal estate and gift tax exemption stands at just over.

That results in a total tax of 345800 on the first 1 million which is 54200 less than. Federal Estate Tax Exemption Sunset Is Not Far Off. The Estate Tax is a tax on your right to transfer property at your death.

The federal estate tax exemption is set to sunset at the end of 2025. The amount you can give during your lifetime or at your death and be exempt from federal estate and gift taxes has risen from 12060000 to. The first 1206 million of your estate is therefore exempt from taxation.

A dies in 2026. The estate planning environment has changed over the last decade. The combined state and federal estate tax liability.

The increase is scheduled to sunset at the end of 2025 which means that starting in 2026 the exemption is set to return to the prior amounts unless the law is again updated. The federal estate tax exemption is set to sunset at the end of 2025 but the impact of a global pandemic and the presidential election will likely accelerate the rollback. In 2018 the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax exemption to 1118 million from 56 million.

Even if the BEA is lower that year As estate can still base its estate tax calculation on the higher 9. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. Maybe not tomorrow but the sunset of our historically high estate tax exemptions is comingand with the election on its way it could be sooner than you think.

A uses 9 million of the available BEA to reduce the gift tax to zero. As the table below shows the first 1 million is taxed at lower rates from 18 to 39. Gift and Estate Tax Exemption.

Your estate wouldnt be. The window for you and your family to transfer wealth to heirs and charities is wide open right now. The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years.

New York Estate Gift Tax Update 2020 Nys Gift Tax

Anticipating Changes In The Federal Estate And Gift Tax Exemption Magee Adler Estate Trust Planning Administration Litigation

The Winds Of Change Are Blowin Pallas Capital Advisors

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Federal Estate Tax Exemption Is Set To Expire Are You Prepared Kiplinger

Federal Estate Tax Portability The Pollock Firm Llc

Estate Tax Planning Tips For Single People Sol Schwartz

New Administration New Estate Tax Complications How To Prepare Clients For The Big Shift Vanilla

2020 Year End Estate Tax Planning Part One Gould Cooksey Fennell

Estate And Inheritance Taxes Around The World Tax Foundation

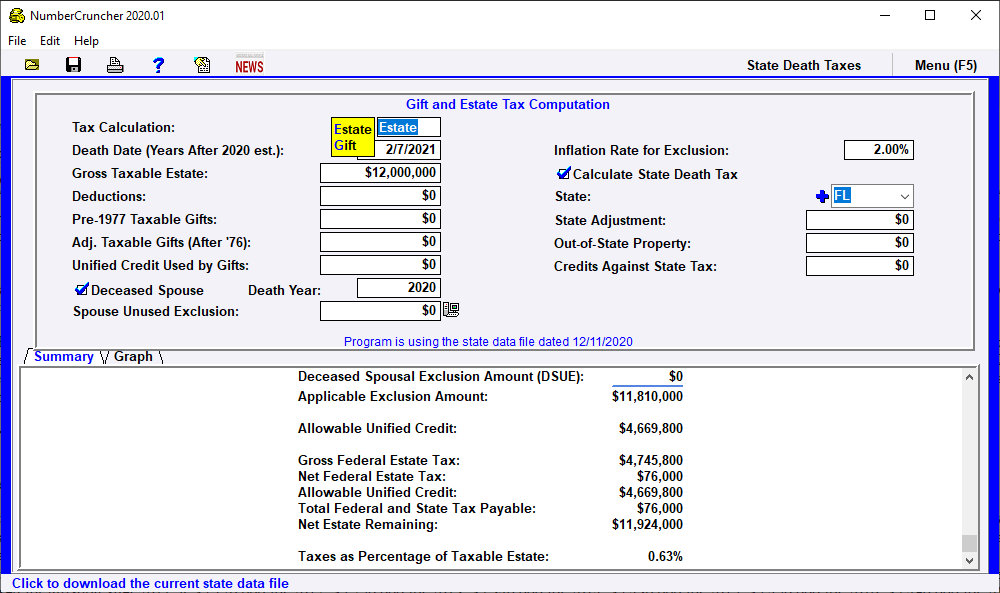

Estate Tax Gift And Estate Tax Computation Leimberg Leclair Lackner Inc

No Need To Fear A Federal Claw Back Twomey Latham

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Recent Changes To Estate Tax Law What S New For 2022 Jrc Insurance Group

2018 Estate Gift And Gst Tax Exemption Officially Published Wealth Management